In the fintech space, where milliseconds matter and regulations run deep, your tech stack is the backbone of your product. It’s not just about what language or framework you use. It’s about making choices that affect performance, compliance, scalability, and even funding prospects.

A poor choice can lead to slow performance, security breaches, or compliance failures. A smart one can help you launch faster, scale confidently, and stay ahead of the curve.

So, what exactly is a tech stack?

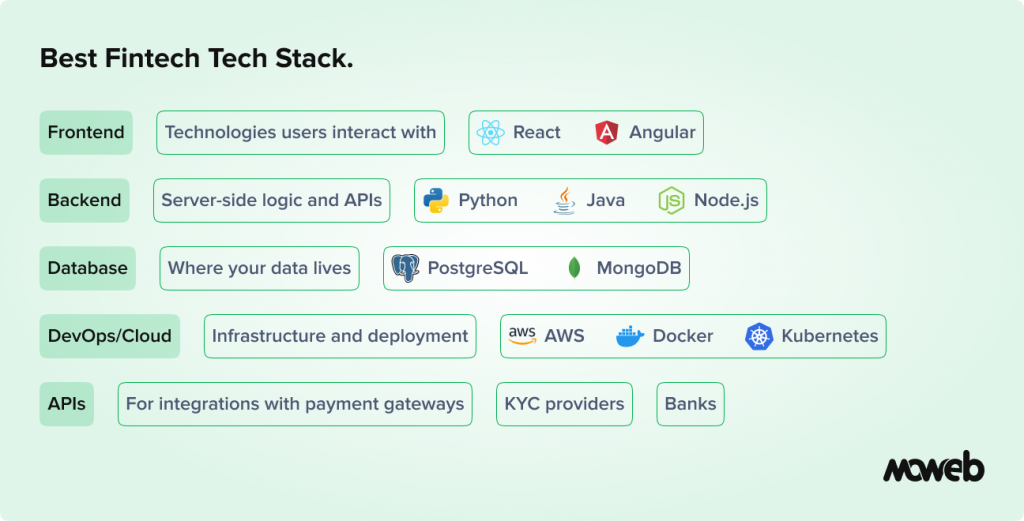

Think of it as the toolkit behind your app—a combination of frontend, backend, database, APIs, and DevOps technologies working together to power your product.

Let’s explore how to select the best fintech tech stack for your project.

Building a Fintech Product?

Start with the frameworks your team already knows.Partner with the industry’s leading Fintech Software Firm.

What is a Tech Stack in Fintech?

A fintech tech stack typically includes:

Example: A digital banking app may use Java (Spring Boot) for backend, PostgreSQL for database, React for frontend, and AWS for hosting—all components of its fintech software architecture.

Understand Your Fintech Product Needs

Before choosing your fintech tech stack, step back and assess your product goals.

Are you building a:

- Lending platform?

- Digital wallet?

- Investment advisor tool?

- Cryptocurrency exchange?

Ask yourself:

- What problem are you solving?

- Who are your users, and what do they expect?

- What compliance standards must you meet?

- Will your product need real-time data handling?

Don’t just think in terms of frameworks and tools—think about outcomes. Are you building a payment gateway, digital banking solution, or a peer-to-peer lending app?

Here’s a simple guide:

- Fast transactions: Use lightweight backend tools like Node.js

- Secure authentication: Choose frameworks with built-in support for OAuth and JWT

- Data-heavy platforms: Go with Python or Java and robust database systems

When your tech stack supports your product’s purpose from day one, everything works more smoothly later on. The best technology for fintech software development is one that aligns tightly with your product’s functional, regulatory, and user requirements.

Key Factors to Consider When Building The Best Fintech Tech Stack

1. Security & Compliance

Security in fintech is not a feature—it’s a non-negotiable foundation. You are dealing with sensitive personal and financial data, and any breach could result in irreversible damage to your brand and user trust.

To meet modern fintech security standards, your tech stack must support end-to-end encryption (TLS for data in transit and AES-256 for data at rest), along with secure API protocols to prevent interception or manipulation.

Fintech isn’t just about features—it’s also about trust. Your technology must help you comply with important standards like:

- PCI-DSS for secure payment data

- GDPR and SOC 2 for customer data privacy

- PSD2 for open banking in the EU

Choose a stack that supports data encryption, audit trails, and access control right out of the box. That way, your app isn’t just functional—it’s also ready for regulators.

2. Scalability & Performance

Building for today is not enough—your fintech stack must scale for tomorrow.

Whether you’re onboarding 10 users or 10,000, scalable fintech architecture ensures your app stays responsive and reliable.

Microservices make it possible to scale features independently, preventing bottlenecks as load increases.

Cloud-native technologies like AWS, Azure, or Kubernetes offer elasticity, geo-redundancy, and rapid deployment capabilities. These tools collectively power high-performance fintech apps that can handle spikes in transaction volume, user activity, and regulatory load testing; without compromising speed or stability.

3. Development Speed & Cost

Time-to-market is critical in fintech, especially when investor expectations and competitive pressure are high.

The right stack helps you build a rapid fintech MVP with minimal waste. Frameworks like Django (Python) and Spring Boot (Java) allow for fast, structured development.

If your use case allows it, low-code platforms can speed up internal tooling or administrative interfaces. To ensure cost-effective fintech development, evaluate the total cost of ownership—including infrastructure, developer resources, and support ecosystems, when choosing between open-source vs. commercial tools or custom vs. out-of-the-box solutions.

Related Post: Fintech App Development Cost

4. Team Expertise & Community Support

Even the best stack fails without the right talent to execute it.

You need a team that’s skilled in both technology and the regulatory nuances of finance. Lean toward popular fintech frameworks with robust documentation and community support.

For example, Python (Django/Flask) is favored for its clean syntax and strong ecosystem in analytics and AI. Java (Spring Boot) offers reliability for complex transaction handling, while Node.js is perfect for lightweight, real-time services.

Choosing tools aligned with your team’s fintech developer skills improves productivity, reduces bugs, and accelerates time-to-value.

5. Integration Capabilities

Modern fintech products thrive on seamless connectivity.

Your stack must be designed to easily integrate with third-party services and banking as a service (BaaS) platforms like Synapse, Solarisbank, or Unit.

Supporting fintech API integrations is essential for features like payment processing, account linking, fraud detection, or KYC verification.

Whether it’s integrating with Open Banking APIs, credit bureaus, or identity verification providers like Plaid and Yodlee, your tech stack should allow secure, scalable, and modular connectivity with minimal engineering overhead.

Your tech stack should serve your business model—not the other way around.

See how partnering with the Web Application Development Company can make all the difference.

| Fintech App Type | Recommended Tech Stack |

| Payment Gateway | Node.js, Python (Django), MongoDB, Stripe API |

| Digital Banking | Java (Spring Boot), PostgreSQL, React/Angular, AWS |

| Lending Platform | Ruby on Rails, MySQL, Kubernetes, Plaid API |

| Blockchain/Crypto | Solidity, Go, Hyperledger, Firebase |

No matter the stack, ensure it meets the demands of secure fintech software architecture and supports future-proof tech upgrades.

Matching Your Stack with Business Goals

Your tech stack is more than a set of tools—it’s a growth strategy.

- Prioritize Core Features: Ensure the stack supports your unique functionality (e.g., biometric login, real-time trading)

- Monetization Support: Whether you’re freemium, subscription-based, or transactional, choose platforms that align with your payment flows

- Data-Driven Strategy: Use databases and analytics platforms that help you leverage customer data responsibly

Related Post: Top 7 Fintech Trends To Watch Out In 2025

Common Mistakes to Avoid to Build the Best Fintech Tech Stack

Avoid these fintech development errors:

Choosing trendy but unstable technologies

It’s tempting to chase the latest frameworks or languages, but what’s trending isn’t always what’s reliable. Early-stage or niche technologies may lack the maturity, documentation, or community support needed for enterprise-grade fintech applications. Stability, long-term support, and proven performance should always outweigh hype—especially when handling sensitive financial data.

Ignoring regulatory tech requirements

Compliance isn’t just a legal checkbox—it should influence your architecture from day one. Whether it’s PCI-DSS for payment systems, GDPR for data privacy, or PSD2 for Open Banking, each regulation has technical implications. Ignoring them early on can result in expensive rework, failed audits, or even legal trouble. Your tech stack must enable secure data handling, audit trails, consent management, and encryption by design.

Underestimating cloud costs

While cloud infrastructure offers flexibility, it’s not automatically cost-efficient. Many teams spin up powerful cloud services during development but forget to optimize them for production. Without proper monitoring, scaling, and cleanup strategies, cloud bills can spiral out of control. It’s crucial to model your projected usage early and adopt practices like autoscaling, resource tagging, and budget alerts.

Budget management

Choosing a tech stack without factoring in long-term maintenance costs is a recipe for overspending. Beyond initial development, think about licensing fees, developer availability, infrastructure scalability, and vendor lock-ins. A cost-effective fintech development strategy must strike a balance between current needs and future expenses—without compromising on security or performance.

Perfect API

Many fintech platforms rely heavily on third-party APIs for services like payments, KYC, or currency exchange. But assuming that every API will work seamlessly is a mistake. Not all APIs are equally reliable, well-documented, or secure. Before integrating, evaluate the API’s uptime history, rate limits, versioning strategy, and how it handles error responses. Your backend should also be resilient enough to handle failures or latency from external APIs.

The Numbers Say It All

- Global fintech market size (2024): valued at USD 340.10 billion in 2024, expected to reach USD 394.88 billion in 2025, with a 16.2 % CAGR through 2032.

- Over 88% of financial institutions are now investing in digital fintech products.

- A well-built fintech solution can save businesses over $10 billion annually through automation, compliance efficiency, and smart integrations.

How to Future-Proof Your Fintech Tech Stack

Fintech isn’t just fast-moving, it’s relentlessly evolving. Regulatory shifts, user expectations, and new technologies can all make today’s solutions obsolete tomorrow. That’s why future-proofing your tech stack isn’t optional—it’s critical.

Here’s how to build a stack that won’t just survive, but thrive:

1. Use Modular Architecture for Flexibility and Upgrades

Monolithic systems are rigid and hard to maintain. Modular architecture, on the other hand, breaks your application into smaller, independent components or services. This allows you to upgrade or replace individual parts of the system—say, your payment engine or KYC module—without affecting the rest of the platform. It’s ideal for fintech environments where new regulations or market needs may demand quick pivots.

2. Adopt Cross-Platform Development with Flutter or React Native

Building for just one platform is a missed opportunity. With cross-platform frameworks like Flutter and React Native, you can maintain a single codebase while deploying across iOS, Android, and even web apps. This not only reduces development time and cost but ensures consistent user experience across devices—an essential requirement in fintech where users expect smooth, reliable access on-the-go.

3. Ensure AI/ML Readiness for Analytics and Fraud Detection

Machine learning isn’t a bonus anymore—it’s becoming a core part of data-driven fintech apps. Whether it’s fraud detection, credit risk scoring, or personalized financial recommendations, your stack should be equipped to handle AI/ML integration. That means choosing databases that support large-scale data operations, using languages and libraries like Python and TensorFlow, and maintaining clean, well-structured data pipelines.

4. Enforce Multi-Factor Authentication (MFA) and Regular Security Audits

Security doesn’t stop at encryption. Future-proof fintech platforms need robust user authentication, ideally through MFA, biometric options, or hardware tokens. Beyond that, regular security audits, penetration testing, and real-time threat monitoring must be baked into your DevSecOps workflow. This proactive approach ensures you’re always a step ahead of new vulnerabilities or compliance requirements.

Conclusion: Building the Best Fintech Stack Has Never Been Easier

The best fintech tech stack balances performance, compliance, and adaptability.

Choosing the best fintech tech stack used to feel like a gamble. Today, with mature frameworks, modular architectures, and cloud-native platforms at your fingertips, it’s a strategic advantage—if done right.

By aligning your stack with your product goals, regulatory needs, and growth plans, you set a strong foundation for long-term success. The tools are ready. The standards are clear. All that remains is choosing with intention, and building with confidence.

FAQs

How much does fintech tech stack selection impact cost?

Choosing the right stack can drastically affect costs. A mismatched stack may lead to rework, slow development, and higher infrastructure expenses. A well-chosen one reduces time to market and ongoing maintenance.

Can I change my tech stack later if needed?

Yes, but it’s often costly and complex. Modular architecture and containerization can make migrations easier. However, making the right choice early on saves time, money, and effort.

Should I go for open-source or proprietary technologies?

Open-source offers flexibility and community support. Proprietary tools may offer better compliance and support. The right choice depends on your specific use case, budget, and compliance needs.

How do I know if my tech stack is secure enough for fintech?

Check for end-to-end encryption, secure API protocols, regular code audits, and compliance with standards like PCI-DSS and GDPR. Work with security-focused development teams.

What is the best database for fintech applications?

PostgreSQL is widely used for its robustness and compliance features. MongoDB offers flexibility but may lack in transactional reliability for some use cases. Choose based on data structure and compliance.

How important is cloud computing in fintech?

Cloud platforms like AWS or Azure offer scalability, security, and cost-effectiveness. They are essential for modern fintech apps, especially those needing rapid scaling and geographic flexibility.

Which APIs are essential for fintech?

Essential APIs include those for payments (Stripe, Razorpay), banking (Plaid, Yodlee), identity (Auth0), and KYC/AML services. Your choice depends on your region and product category.

Found this post insightful? Don’t forget to share it with your network!