In the fast-evolving world of financial technology, building a powerful, secure, and scalable FinTech app is more than a trend—it’s a strategic necessity. From digital wallets to investment platforms, the demand for digital finance solutions continues to surge.

But what is the real FinTech app development cost in 2025? How can you plan a financial software budget that delivers ROI without compromising quality?

This guide offers a complete breakdown of the cost to build a FinTech app—covering everything from cost to build FinTech app per month, feature choices to compliance, and ongoing maintenance. Whether you’re a bank, startup, or SaaS provider, understanding your investment in FinTech development expenses is crucial to making informed, future-ready decisions.

Why Invest in a FinTech App?

The FinTech boom is driven by more than hype. Here’s why financial institutions and tech-driven companies are doubling down on digital finance solutions:

- Rapid increase in cashless transactions and mobile-first users.

- Growing consumer preference for on-demand financial services.

- Demand for automation, transparency, and personalization in finance.

- Competitive edge through faster services, lower overheads, and data-driven insights.

- Scalable digital payment benefits that improve ROI.

Modern fintech apps are increasingly leveraging AI and machine learning development to deliver smarter financial solutions – from fraud detection algorithms that analyze transactions in real-time to ML-powered chatbots that provide personalized banking assistance.

Key Factors Affecting FinTech App Development Cost

The total FinTech app development cost varies significantly depending on multiple variables. Here’s what impacts your investment the most:

App Type & Complexity

The nature of your app—whether it’s a simple budgeting tool or a full-fledged mobile banking solution—sets the baseline for your cost. Simpler apps with basic functionality (like tracking expenses) require fewer resources. In contrast, complex apps like digital lending platforms or investment tools demand real-time processing, advanced security, and complex backend logic, significantly increasing development time and cost.

Must-Have Features & Their Costs

Core features such as user authentication (biometric logins, OTP verification, 2FA) are non-negotiable in any FinTech solution. These features not only enhance security but also help with regulatory compliance.

Transactional modules, analytics dashboards, and push notifications are essential for user engagement and data-driven services. Each of these comes with its own development and integration costs—ranging from thousands to tens of thousands of dollars depending on complexity and scope.

Development Team & Location

Where your FinTech software development company and their team is located directly influences hourly rates and total cost to develop FinTech app. Hiring a team in the US or UK can provide proximity and domain expertise but at a premium. Offshore teams in India or Eastern Europe offer significant cost savings without necessarily compromising quality—especially when working with FinTech-experienced vendors.

Tech Stack & Third-Party Integrations

The technologies you choose—from backend frameworks like Node.js or Django to frontend libraries like React Native—can affect scalability, performance, and future maintenance costs. In addition, most FinTech apps require third-party services like payment processors, KYC/AML solutions, and analytics tools. Licensing, integration effort, and API call volume charges can all add to the final expense.

UI/UX Design & Testing

An intuitive and secure user experience is essential in gaining user trust in financial apps. Professional UI/UX design ensures usability and compliance with accessibility standards. cost to build FinTech app also include usability testing, A/B testing, and device responsiveness. Post-design, rigorous QA testing ensures the app is free from bugs, secure against threats, and performs well under real-world conditions.

Integrations with Third-Party Services

FinTech apps often need to integrate with banking APIs, credit bureaus, financial data providers, or identity verification services. These integrations require both development time and ongoing API usage fees. The more integrations you require—and the more complex their data exchange protocols—the higher your app development and maintenance costs will be.

Regulatory Compliance and Security Measures

FinTech apps must comply with a host of regional and global financial regulations—like PCI DSS, GDPR, SOC 2, and local data protection laws. Ensuring encryption, secure data storage, access control, and audit trails are built into your app increases both development time and budget. Investing in compliance upfront helps prevent costly penalties and reputational damage down the line.

Need help choosing the right FinTech solution?

From mobile banking to investment apps, every use case needs a different approach.

Talk to us and build the right app for your business.

Need help choosing the right FinTech solution?

From mobile banking to investment apps, every use case needs a different approach. Talk to us.

FinTech App Types and Associated Cost Ranges

Each category of FinTech app comes with its own functionality, compliance needs, and user expectations—which directly impact the total FinTech app development cost. Below is a breakdown of estimated development costs for popular FinTech app types in 2025.

Mobile Banking App Development Cost

Mobile banking apps are complex systems that typically include features such as account management, fund transfers, transaction history, bill payments, support chat, and card management.

They also require multi-layered security, regulatory compliance, and deep backend integration with core banking systems. Due to the critical nature of banking apps and their broad feature set, cost to develop FinTech app generally range from $80,000 to $250,000, depending on the number of features and supported platforms (iOS, Android, Web).

Payment App Development Price

Payment apps are designed to facilitate peer-to-peer (P2P) transfers, mobile wallet functionality, QR code payments, and merchant integrations. These apps need to be lightning-fast, secure, and capable of handling large transaction volumes while complying with financial regulations like PCI DSS.

Advanced fraud detection, dispute resolution, and wallet top-ups add further complexity. Development costs typically fall between $60,000 to $200,000, with the final budget influenced by geographic coverage, payment gateway choices, and currency support.

Investment App Development Cost

Investment apps include platforms for stock trading, cryptocurrency exchanges, robo-advisors, and wealth management dashboards.

They often require real-time market data integrations, complex algorithms for portfolio analysis, risk profiling, and secure APIs to execute trades.

These apps also need regulatory compliance with bodies like SEC or SEBI. Given the heavy backend processing and sensitive data handling, the development cost ranges from $100,000 to $300,000, depending on scope and depth of trading features.

Lending App Development Cost

Lending applications can support peer-to-peer lending, microloans, personal or business loan origination, and credit score analysis.

These apps often include borrower verification, KYC/AML compliance, EMI calculators, automated decision engines, and repayment tracking. A high level of security, integration with credit bureaus, and automated workflows are typically required.

The estimated cost to build such apps ranges from $70,000 to $250,000, depending on loan complexity and region-specific compliance requirements.

Budgeting and Personal Finance Management App Cost

These apps are relatively simpler in scope and are typically focused on helping users track spending, set savings goals, categorize expenses, and receive financial insights.

Key features include linking with bank accounts, personalized recommendations, bill reminders, and visual dashboards. As these apps don’t usually involve handling actual transactions, the compliance and integration requirements are lighter.

Development costs for budgeting apps generally range between $40,000 to $120,000, with the lower end covering MVPs and the higher end including AI-powered insights and multi-device support.

Read More: Explore more on Top Fintech Trends to understand why building a FinTech app in 2025 is a smart move

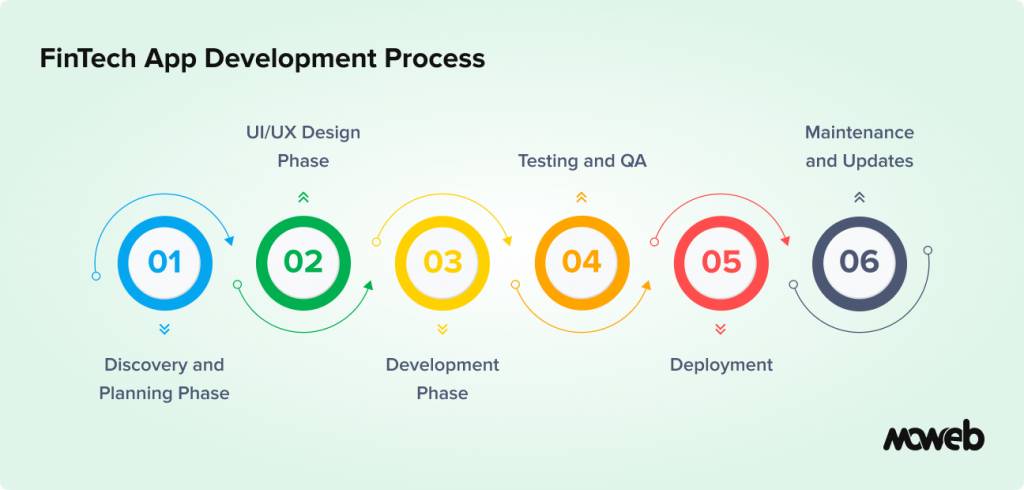

FinTech App Development Process and Costs

Each development phase plays a distinct role in shaping your app’s functionality, security, and user experience. Here’s a breakdown of what each stage involves and its typical cost contribution:

Discovery and Planning Phase

This phase includes market research, competitor analysis, technical feasibility checks, and requirement documentation. It sets the foundation and usually costs $5,000 to $20,000.

UI/UX Design Phase

Wireframes, user flows, and high-fidelity mockups are created to ensure intuitive design and regulatory alignment. Design costs range from $5,000 to $25,000.

Development Phase (Frontend and Backend)

This is where actual coding happens—building interfaces, APIs, and core logic. It’s the most expensive stage, consuming 40–60% of the total budget ($40,000 to $150,000+).

Testing and Quality Assurance (QA)

Covers functional, security, usability, and performance testing to ensure the app works flawlessly and is secure. QA typically accounts for 15–25% of the total cost.

Deployment

The app is packaged, published to app stores or internal environments, and linked to cloud services. Deployment costs usually range between $2,000 to $10,000.

Post-Launch Maintenance and Updates

Ongoing support includes bug fixes, feature rollouts, performance monitoring, and compliance updates. Expect monthly costs between $3,000 to $15,000, depending on scope.

Working with a limited budget?

We’ll help you build an MVP that’s cost-effective and scalable. Consult us to optimize your FinTech development spend

How to Get an Accurate FinTech App Development Cost Estimate

Getting an accurate cost to develop FinTech app starts with clarity. Before approaching any development partner, ensure you have a well-defined project scope. This means outlining your core features, target platforms (iOS, Android, Web), compliance requirements, user flows, and any third-party integrations you’ll need. The more detailed your Software Requirement Specification (SRS) is, the more precise and transparent the estimate will be.

It’s also essential to break your app into phases—starting with an MVP (Minimum Viable Product) and defining what success looks like at each stage. This helps vendors map effort to outcomes and reduces ambiguity. Avoid vague goals like “build an app like PayPal” and instead focus on functional requirements like “enable peer-to-peer payments with KYC and transaction history.”

Finally, choose development partners who specialize in FinTech and understand the intricacies of financial compliance, security protocols, and regulatory landscapes. Ask for itemized proposals, timelines, and examples of similar work. A good partner will not just quote a number—they’ll help you optimize scope, recommend the right tech stack, and flag potential risk areas upfront.

Strategies to Optimize and Manage Your FinTech App Development Budget

Smart financial planning is just as important as smart coding when it comes to building a FinTech app. One of the most effective ways to reduce initial costs is by starting with a Minimum Viable Product (MVP).

An MVP focuses only on the core functionalities needed to validate your idea and gain user feedback. This lets you test the waters, minimize risk, and build only what your audience actually needs—before investing in full-scale development.

Next, prioritize features based on user value and business impact. Avoid the temptation to build everything at once.

Instead, identify high-impact modules like secure user authentication, transaction management, or compliance workflows, and defer secondary features for future releases. This phased approach allows you to manage resources more effectively and respond to market needs with agility.

Finally, choosing the right development partner can make or break your budget. Look for firms with FinTech expertise, transparent pricing models, and a proven track record.

Whether you opt for a fixed-price or time-and-material engagement model depends on how clearly defined your scope is. Fixed-price models work well for well-scoped MVPs, while time-and-material models offer more flexibility for evolving projects.

Ready to build your FinTech app?

Let’s turn your idea into an user-friendly product. Talk to us and start your FinTech journey today

Conclusion: Investing Wisely in Your Financial App’s Future

The cost of developing a FinTech app in 2025 is influenced by multiple factors—ranging from app type and complexity to your choice of tech stack, compliance needs, and development team location. Understanding these variables upfront helps you avoid surprises and align your financial software budget with business goals. Whether you’re building a mobile banking solution or a lightweight budgeting tool, clarity on scope and smart planning are key to success.

Remember, there is no one-size-fits-all answer to FinTech development expenses. Your investment will ultimately depend on what you’re trying to build, who it’s for, and how fast you need to bring it to market. Prioritizing must-have features, starting with an MVP, and partnering with the right experts can help you stay on budget without compromising quality.

As digital finance solutions continue to evolve, investing in a secure, scalable, and user-friendly app is no longer optional—it’s a strategic advantage. In a market driven by trust, experience, and compliance, building your FinTech application the right way sets you up for long-term growth, innovation, and customer loyalty.

FAQs

How much does it cost to build a Fintech app?

The cost typically ranges from $40,000 to $300,000+ depending on the app’s scope.

More advanced apps with AI, real-time sync, or compliance features cost significantly more.

The final price is shaped by team location, integrations, and security requirements.

How long does it take to develop a Fintech app?

A basic FinTech MVP can take 3–4 months, while full-featured apps may need 6–12 months.

Complex features like trading engines or KYC systems extend timelines further.

Timely delivery depends on team expertise, clarity of scope, and iterative development.

What factors influence the cost to build a Fintech app the most?

Core cost drivers include the app’s complexity, feature set, and security requirements.

Development team rates vary by region and significantly impact the overall budget.

Compliance needs, integrations, and scalability goals also raise total expenses.

How can I reduce the cost of developing a fintech app?

Start with a clear, focused MVP that covers only essential features.

Use open-source tools and pre-built integrations where possible.

Choose a FinTech-savvy development partner who avoids rework and scope creep.

What are some common “hidden costs” in FinTech app development?

Third-party services like payment gateways or KYC tools often carry usage fees. Post-launch maintenance, hosting, and compliance audits are ongoing costs.

Security certifications and regulatory updates can also increase the budget later.

How can I monetize my Fintech app?

You can charge transaction fees, offer paid subscriptions, or upsell advanced features.

Advertising, affiliate offers, or white-labeled APIs are also common revenue channels.

The best strategy depends on your audience and how often they engage with the app.

What is the typical timeline for developing a FinTech application?

Most FinTech apps take between 6 to 12 months from planning to launch.

Simple tools may go live faster, while high-security apps take longer.

Proper planning and phased releases can keep timelines under control.

Found this post insightful? Don’t forget to share it with your network!